1031 Qualified Intermediary Services

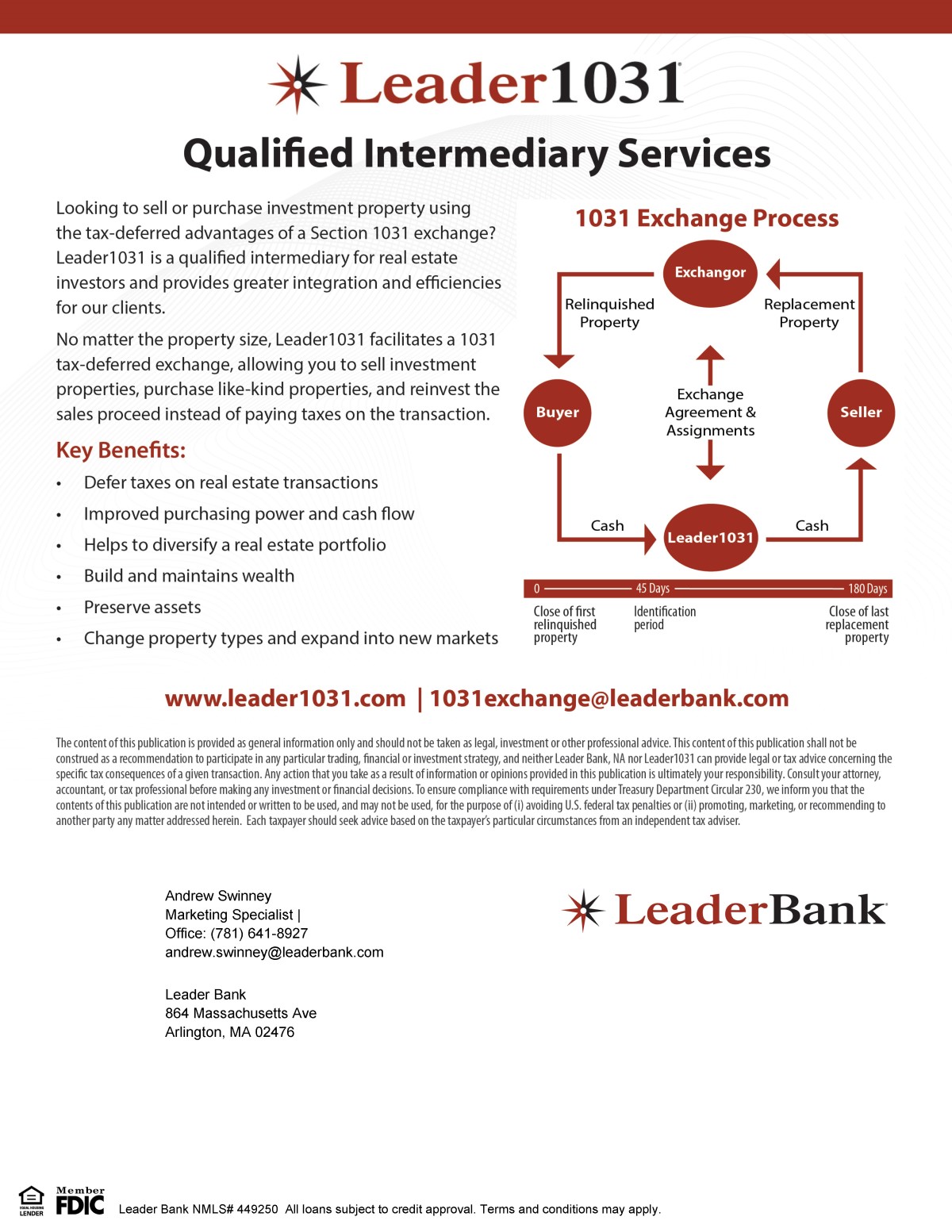

Looking to sell or purchase investment property using the tax-deferred advantages of a Section 1031 exchange? Leaderl 031 is a qualified intermediary for real estate investors and provides greater integration and efficiencies for our clients. No matter the property size, Leaderl 031 facilitates a 1031 tax-deferred exchange, allowing you to sell investment properties, purchase like-kind properties, and reinvest the sales proceed instead of paying taxes on the transaction.

Key Benefits:

- Defer taxes on real estate transactions

- Improved purchasing power and cash flow

- Helps to diversify a real estate portfolio

- Build and maintains wealth Preserve assets

- Change property types and expand into new markets

The content of this publication is provided as general information only and should not be taken as legal, investment or other professional advice. This content of this publication shall not be construed as a recommendation to participate in any particulartrading, financial or investment strategy, and neither Leader Bank, NA nor Leader1031 can provide legal or tax advice concerning the specific tax consequences of a given transaction. Any action that you take as a result of information or opinions provided in this publication is ultimately your responsibility. Consult your attorney, accountant, or tax professional before making any investment or financial decisions. To ensure compliance with requirements under Treasury Department Circular 230, we inform you that the contents of this publication are not intended or written to be used, and may not be used, for the purpose of (i) avoiding U.S. federal tax penalties or (ii) promoting, marketing, or recommending to another party any matter addressed herein. Each taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax adviser.