Buying vs. Renting

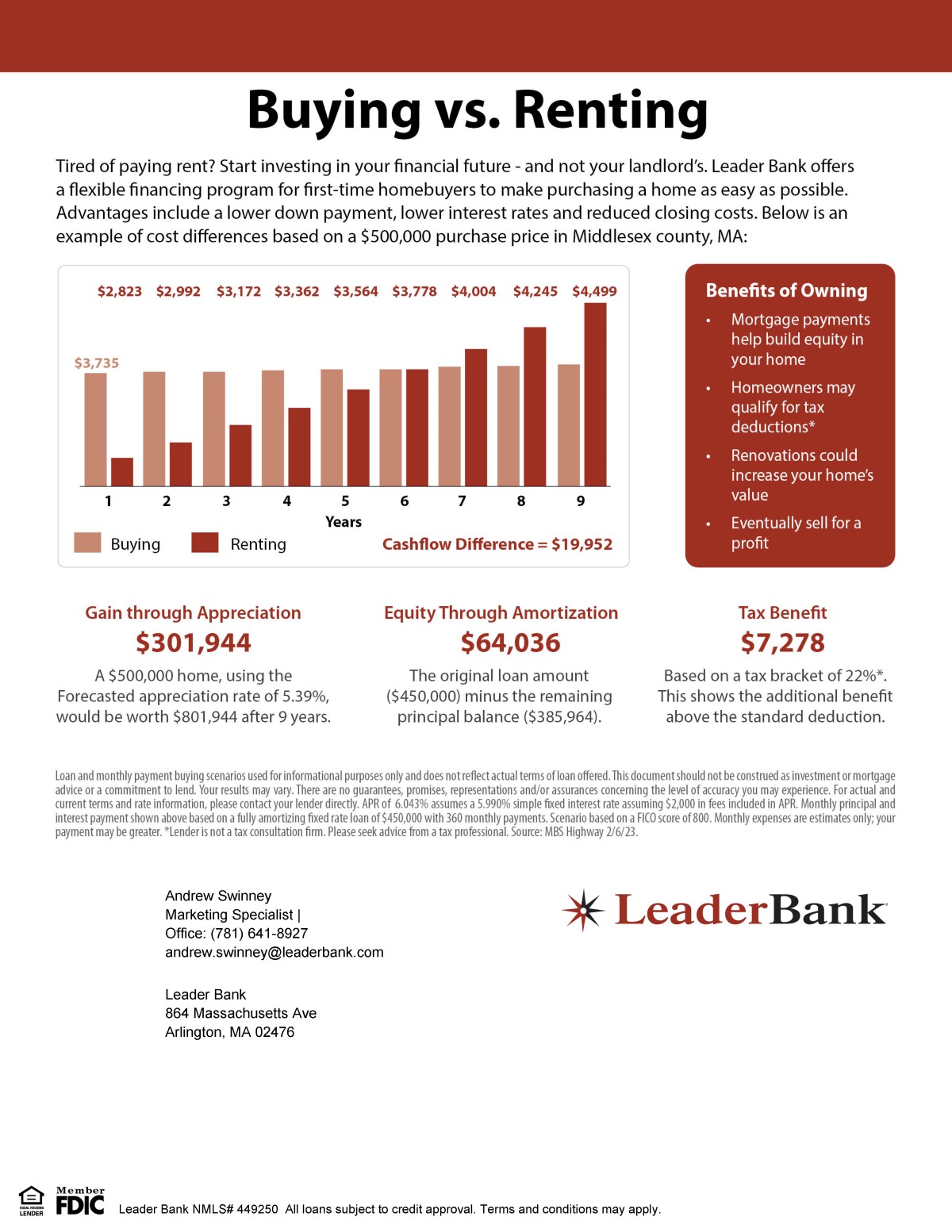

Tired of paying rent? Start investing in your financial future - and not your landlord's. Leader Bank offers a flexible financing program for first-time homebuyers to make purchasing a home as easy as possible. Advantages include a lower down payment, lower interest rates, and reduced closing costs. Below is an example of cost differences based on a $500,000 purchase price in Middlesex County, MA:

Benefits of Owning:

- Mortgage paymentshelp build equity in your home

- Homeowners may qualify for tax deductions*

- Renovations could increase your home's value

- Eventually sell for a profit

Gain through Appreciation: $301,944

A $500,000 home, using the Forecasted appreciation rate of 5.39%, would be worth $801,944 after 9 years.

Equity Through Amortization: $64,036

The original loan amount ($450,000) minus the remaining principal balance ($385,964).

Tax Benefit: $7,278

Based on a tax bracket of 22%*. This shows the additional benefit above the standard deduction.

Loan and monthly payment buying scenarios used for informational purposes only and does not reflect actual terms of loan offered. This document should not be construed as investment or mortgage advice or a commitment to lend. Your results may vary. There are no guarantees, promises, representations and/or assurances concerning the level of accuracy you may experience. For actual and current terms and rate information, please contact your lender directly. APR of 6.043% assumes a 5.990% simple fixed interest rate assuming $2,000 in fees included in APR. Monthly principal and interest payment shown above based on a fully amortizing fixed rate loan of $450,000 with 360 monthly payments. Scenario based on a FICO score of 800. Monthly expenses are estimates only; your payment may be greater. *Lender is not a tax consultation firm. Please seek advice from a tax professional. Source: MBS Highway 2/6/ 23.