Credit 101

Your credit score is a numerical representation of your statistical likelihood to repay the credit that is extended to you. A credit score is a snapshot of a specific moment in time but can and will change with new actions and the passage of time.

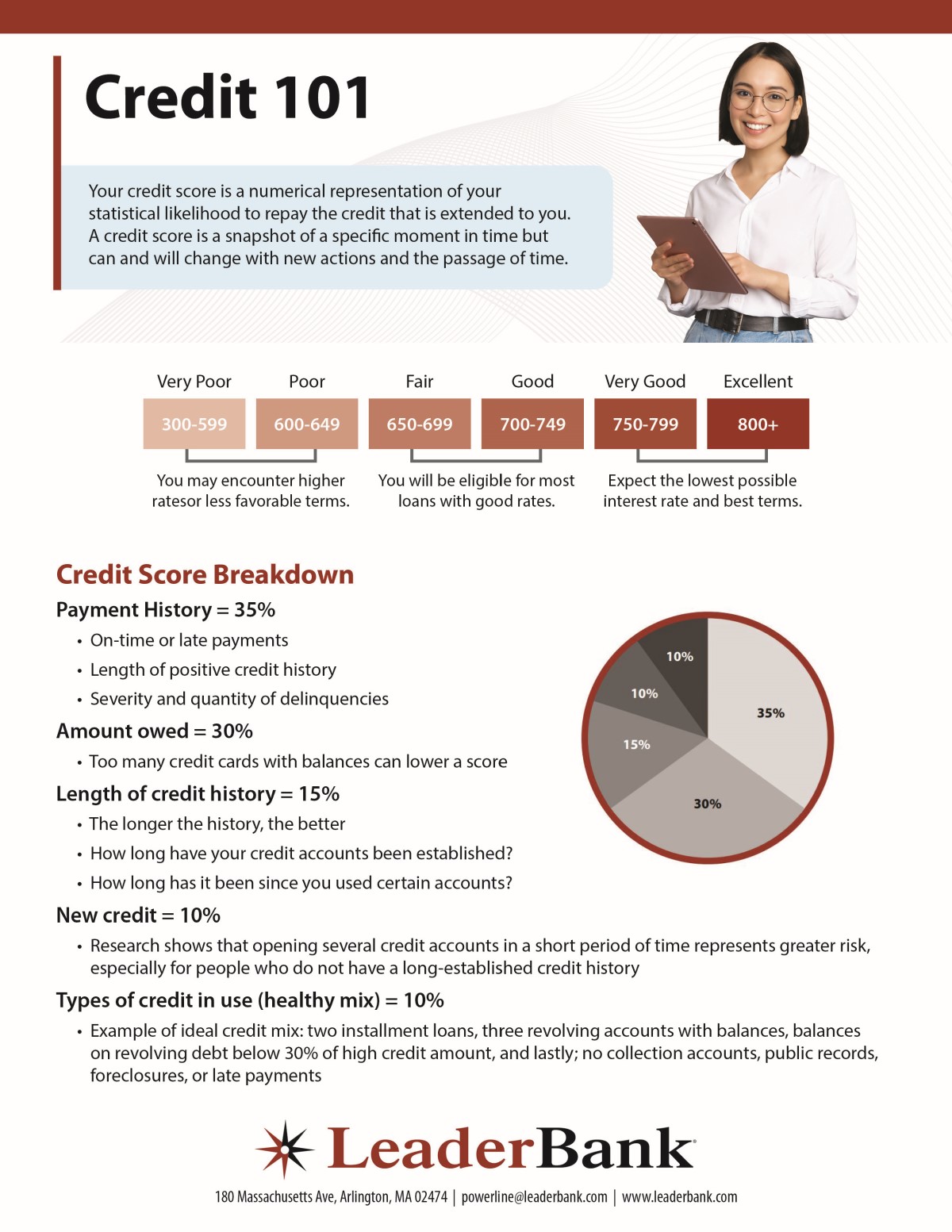

Credit Score Breakdown

Payment History= 35%

- On-time or late payments

- Length of positive credit history

- Severity and quantity of delinquencies

Amount owed = 30%

- Too many credit cards with balances can lower a score

Length of credit history= 15%

- The longer the history, the better

- How long have your credit accounts been established?

- How long has it been since you used certain accounts?

New credit = 10%

- Research shows that opening several credit accounts in a short period of time represents greater risk, especially for people who do not have a long-established credit history

Types of credit in use (healthy mix)= 10%

- Example of ideal credit mix: two installment loans, three revolving accounts with balances, balances on revolving debt below 30% of high credit amount, and lastly; no collection accounts, public records, foreclosures, or late payments

Tips for Maintaining Favorable Credit Scores

- Monitor your credit. Order a copy of your free credit report from each of the three major bureaus annually from www.annualcreditreport.com.

- Pay all of your bills on time or early. Even a 30-day late notice on a small credit card can have a significant impact on your scores.

- Don't cosign loans. Their late payments are your late payments and will negatively impact your credit scores.

- Avoid using more than 30% of your balance each month.

- Don't close old revolving accounts no longer in use. It helps your scoring when accounts open with zero balances.

- Don't extend open new accounts unless absolutely necessary. Inquiries may or may not affect your score depending on the rest of your credit history.

- Report fraud immediately. If you find yourself the victim of fraud, immediately contact the credit bureaus, the credit card companies, banks, and the FTC at www.ftc.gov

Note: Please know that you may be contacted by competing lenders immediately after we pull your credit because the major credit bureaus maylegally sell your information. Here's how you can STOP this from happening to you. Go to optoutprescreen.com or call 1-888-5-0PT-OUT (1-888-567-8688) to opt out for five years or permanently. The major credit bureaus operate the phone number and website. Requests to opt out areprocessed within five days, but it may take several weeks before you stop getting prescreened offers. This is because some companies may havegotten your information before your opt out request was processed. Go to donotcall.gov or call 1-888-382-1222 from the phone you want to register. If you register your number at DoNotCall.gov, you'll get an email with a link you need to click on within 72 hours to complete yourregistration. It can take up to 31 days for sales calls to stop.