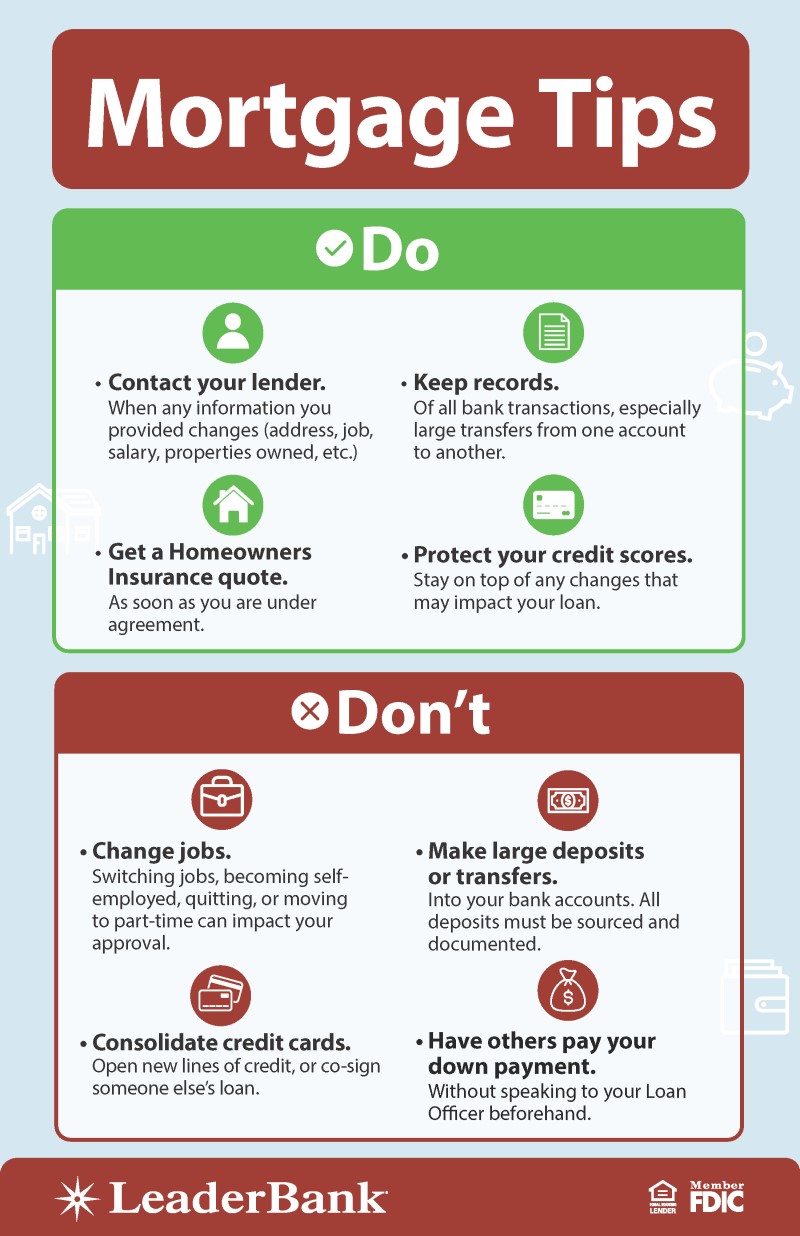

DOs and DON'Ts of the Mortgage Process

DO

- Contact your lender. When any information you provided changes (address, job, salary, properties owned, etc.)

- Keep records. Of all bank transactions, especially large transfers from one account to another.

- Get a Homeowners Insurance quote. As soon as you are under agreement.

- Protect your credit scores. Stay on top of any changes that may impact your loan.

DON'T

- Change jobs. Switching jobs, becoming self-employed, quitting, or moving to part-time can impact your approval.

- Make large deposits or transfers. Into your bank accounts. All deposits must be sourced and documented.

- Consolidate credit cards. Open new lines of credit, or co-sign someone else’s loan.

- Have others pay your down payment. Without speaking to your Loan Officer beforehand.