Mortgage Buydowns Explained

Finding the right home can be challenging on its own. Homebuyers are also understandably concerned about higher interest rates increasing their monthly payment. It's difficult to find the perfect home that fits your current budget. If you're looking for a solution that can help make the transition to new mortgage payments more manageable, a buydown could help!

Finding the right home can be challenging on its own. Homebuyers are also understandably concerned about higher interest rates increasing their monthly payment. It's difficult to find the perfect home that fits your current budget. If you're looking for a solution that can help make the transition to new mortgage payments more manageable, a buydown could help!

Can a buydown help me get a lower interest rate?

A buydown reduces your monthly payments for an initial period. Typically, the seller contributes funds to an escrow account that subsidizes the mortgage for an initial period, resulting in a lower monthly mortgage payment for the buyer. In turn, the seller will usually increase the purchase price to compensate for the costs of the buydown.

Is a buydown a good fit?

Not all mortgages are eligible for a buydown, including loans to purchase investment properties. Government-backed loans have specific guidelines pertaining to buydowns. There are also alternative methods to lower payments. Ask your loan officer about other options that may be right for you or the option of purchasing "discount points"to reduce the interest rate for the life of the loan instead of just a few years.

How does a buydown work?

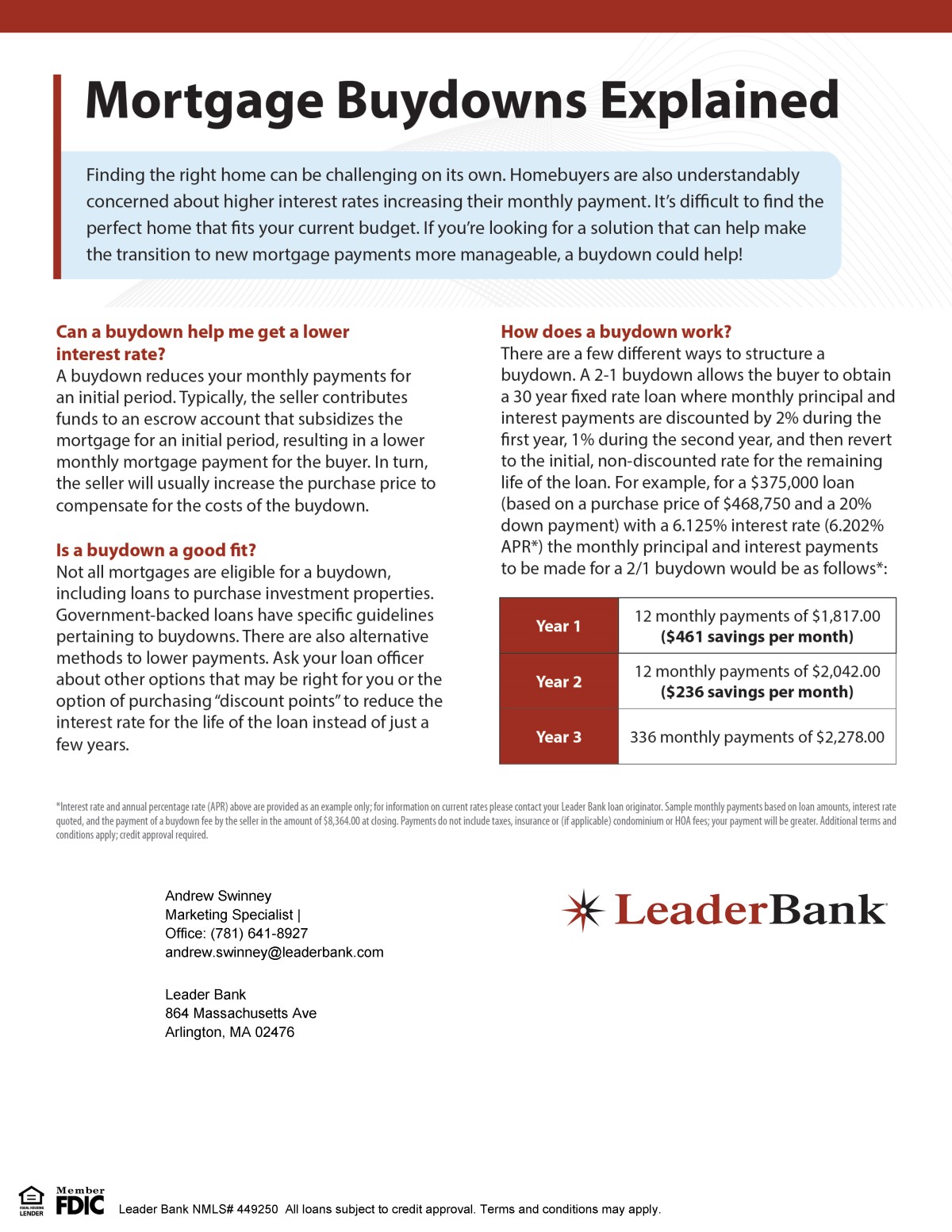

There are a few different ways to structure a buydown. A 2-1 buydown allows the buyer to obtain a 30 year fixed rate loan where monthly principal and interest payments are discounted by 2% during the first year, 1 % during the second year, and then revert to the initial, non-discounted rate for the remaining life of the loan. For example, for a $375,000 loan (based on a purchase price of $468,750 and a 20% down payment) with a 6.125% interest rate (6.202% APR*) the monthly principal and interest payments to be made for a 2/1 buydown would be as follows*

*Interest rate and annual percentage rate (APR) above are provided as an example only; for information on current rates please contact your Leader Bank loan originator. Sample monthly payments based on loan amounts, interest rate quoted, and the payment of a buydown fee by the seller in the amount of $8,364.00 at closing. Payments do not include taxes, insurance or (if applicable) condominium or HOA fees; your payment will be greater. Additional terms and conditions apply; credit approval required.