Market Knowledge

Partner Portal | Knowledge | Tools | Information

Market Updates

3/31/25

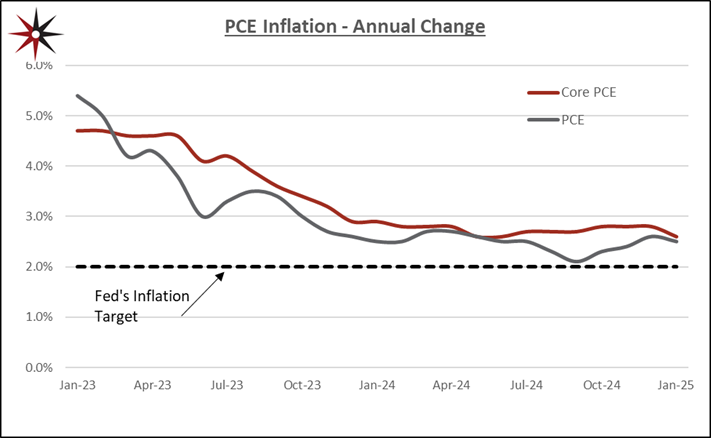

On goes the roller coaster of current market volatility and uncertain expectations for the short-term. This morning’s headline news was the PCE Inflation, which is the Federal Reserve’s preferred inflation measure. Expectations were calling for an increase from the prior month. The headline PCE increased by 2.5% from a year ago, the same annual pace as last month. Removing the more volatile food and energy prices, Core PCE increased by 2.8%, causing alarms as this was 0.1% higher than expected and 0.2% higher than the prior months’ reading. A few weeks ago we got a hint that the there may be some stalling in the progress of inflation towards the Fed’s 2% goal when the University of Michigan’s Consumer Sentiment Index for February was published showing a pullback in Americans’ confidence in the economic outlook in terms of price expectations with the current strategy of tariffs and uncertainty surrounding the labor market. The pace of change around us has greatly increased in the past few months. The personal savings rate measured in the PCE report ticked up slightly to 4.6%, showing that uncertainty is causing consumers to hold onto their funds rather than spend in the current market. Proposed tariffs starting next week will affect goods from things like 25% on auto imports to tariffs on fruit and vegetable imports from Mexico. Regarding the auto tariffs, even many American brands of autos are produced in Mexico and Canada and will be affected. Auto dealers typically keep around two months’ supply of cars on their lots, so the car buyers are likely to start feeling the tariffs in the summer months. With a much shorter shelf life, grocery shoppers will feel the effect of tariffs on fruits and vegetables much sooner.

Following a disappointing drop in the University of Michigan’s consumer sentiment index for February, the March numbers are falling even more. The index is down another 12% in March, and down 28% from a year prior. The expectations portion of the index is down even more, down 18% from the prior month and 32% from the prior year. The falloff is consistent across all demographic and political affiliations. Two thirds of consumers now expect unemployment to rise in the coming year, the highest reading in the survey since 2009. Additionally, inflation expectations for the coming year have increased to 5.0% this month from 4.3% last month; and longer run inflation expectations (5-10 years) rose to 4.1% from 3.5% in the prior month. These changes in expectations reflect American’s uncertainty around how to sustain their standards of living amid higher prices and a potentially changing labor market.

The content of this publication is provided for informational purposes only and is not intended to recommend any financial decision or course of action. Any financial and investment decision should be made in consultation with your financial advisors and representatives and should be evaluated at your own risk.

3/14/25

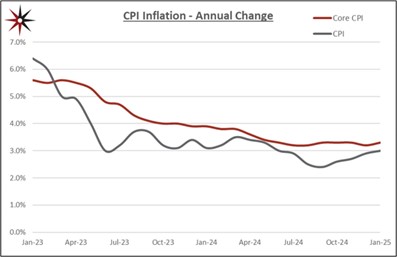

It’s 3/14, happy Pi Day to everyone! How many digits can you recite on the famous Pi mathematical concept which represents the ratio of a circle’s diameter to its circumference. I stop at 3.14159, do you know more than me? If you do, hold on popping the bubbly to celebrate, as the Trump administration is threatening 200% tariffs on European alcohol imports – including French champagne and Italian prosecco. This was in response to the EU slapping tariffs of 50% on Tennessee whiskey and other US produced alcohol. Continued tariff battles with Canada and Mexico also threaten US made bourbon exports to Canada and imports of Mexican tequila. An uncertain near-term economy is fully dominating as market drivers as policy changes could upend the current strength of the economy. This week’s CPI reading showed additional progress in reducing inflation and seemed to agree with last month’s January PCE report which also showed inflation pressures easing and the pace of price gains slowing. However, later in the week the inflation expectation is again shifting as expectations for the February PCE, to be published on March 28th, are now calling for a pickup in price increases.

Wednesday’s report on February CPI showed that price levels increased 2.8% over the past 12 months, which is lower than the 3.0% pace from the prior month. Core CPI also fell to 3.1% from 3.3% in the prior month.

Tariff worries appear to be wearing on the American consumer, with this week’s University of Michigan consumer sentiment index falling to the lowest reading since 2022. Expectations for the future are falling as uncertainty is reigning supreme as Americans are unsure what tariffs will mean for the cost of goods and what it will mean if a significant number of federal workers no longer have jobs. Equity markets have fallen some 7% since the start of February as unknown changes to regulatory and geopolitical environment have hurt growth prospects.

In other news, it appears that we will avoid a government shut down as Senate Democrats are ready to vote in favor of the Republican’s funding bill, which will fund the government through the remainder of the year. Senate minority leader Chuck Schumer appears to be encouraging fellow Democrats in the Senate to vote to approve the funding, rather than cause a government shutdown, which could play into the plans for closing additional parts of the federal government.

The Federal Reserve meets next week where Jay Powell and crew will reveal their latest understanding of the US economy. No rate changes are expected at this meeting, but as the economy and expectations have been in flux this year, expectations for Fed rate cuts have been constantly changing as well. Just a few weeks ago the largest expectation was for no cuts all year, now expectations are largely for 2-3 cuts. Markets will be closely watching what the Fed has to say about recent policy updates and how the ever-changing landscape of tariffs may pressure US economic growth, inflation and the labor market.

The content of this publication is provided for informational purposes only and is not intended to recommend any financial decision or course of action. Any financial and investment decision should be made in consultation with your financial advisors and representatives and should be evaluated at your own risk.

2/28/25

Markets have been on the move this week, with the yield on the 10-year Treasury falling by 22 basis points. Today’s PCE inflation report showed that Core PCE Inflation rose by just 2.6% over the past 12 months. This matches back to the May and June readings of last year and aside from those two months it is the lowest Core PCE since back to March 2021. Headline PCE rose at a 2.5% pace over the prior 12 months, a decline of 0.1% from the prior month’s reading. On a monthly basis both the headline and core readings showed a 0.3% increase in price levels from the prior month. The report highlighted the continuing increase in prices for housing and food, however it also showed Americans spent less in January on motor vehicles and recreation goods than in the prior month. Personal incomes rose by 0.9% in January, well above 0.4% in the previous month, and spending fell by 0.2% compared to a 0.8% increase in the previous month. The personal savings rate was up to 4.6%, also an increase from the prior month. This month’s reduction in Core PCE is a welcome signal for the Federal Reserve as Core PCE had been stuck in a 2.7% - 2.8% range for six consecutive months. The Fed has been clear that one month’s data does not make a trend, and I would tend to agree here. However, markets have been quick to adjust rate cut expectations for the remainder of 2025, with a shift from 15% expectation for no cuts reduced to just 2%. The other main inflation source, the CPI report two weeks ago, showed a surprise increase in price levels for January, so a bit of conflicting inflation news here.

Next week could bring some additional economic news fireworks. The February jobs report will come on Friday morning with the latest signal on the strength of the labor market. Last month the unemployment rate fell by 0.1% with continued solid job growth. This month could show some distortions from government employment as the current administration is reducing the size of the government workforce. Additionally, a new round of import tariffs could take effect on March 4th, with 25% tariffs on Canada and Mexico and an additional 10% on China. A 25% tariff on steel and aluminum is set to take effect the following week on March 12th. The Trump administration continues its quick actions of work on campaign promises.

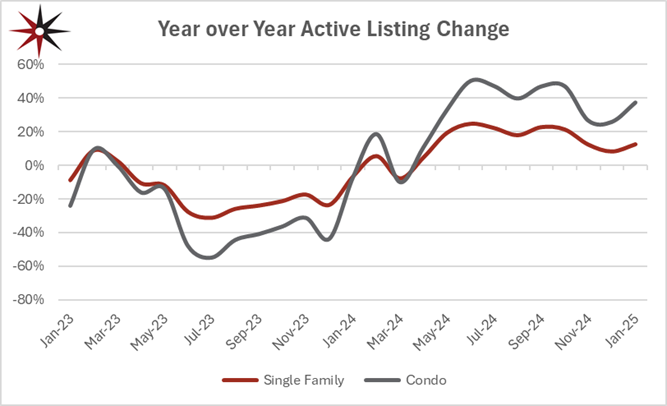

Locally, the Massachusetts housing market is showing some signs of excitement picking up, with positive year-over-year changes in active listings on the market for the 10th consecutive month for single family homes, going back to April of last year. Homebuyers happily welcome additional new inventory as prices remain high, cramping affordability

The content of this publication is provided for informational purposes only and is not intended to recommend any financial decision or course of action. Any financial and investment decision should be made in consultation with your financial advisors and representatives and should be evaluated at your own risk.

2/21/25

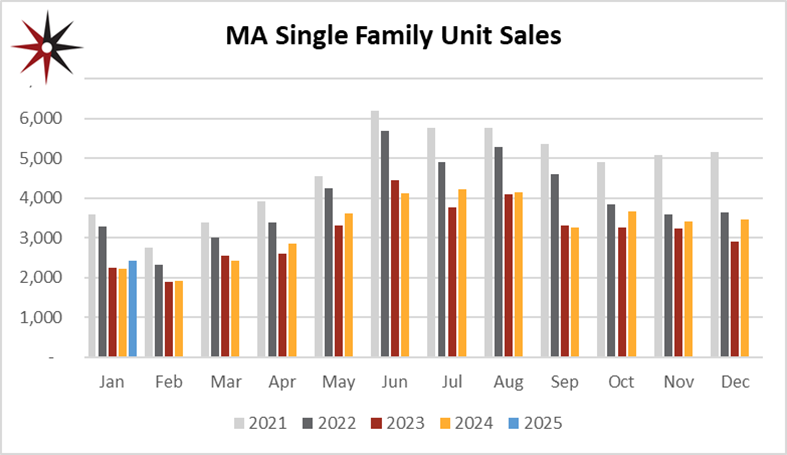

Home prices and higher interest rates continue to be a drag on the US housing market. January sales of existing homes fell, after rising each month during the fourth quarter to close out last year. The National Association of Realtors reported that January existing home sales fell 4.9% from the prior month, which was a greater decline than was expected. However, January is starting 2025 off brighter than last year with this year up 2.0% compared to January of the prior year and the fourth consecutive monthly year-over-year increase. Home prices continue to rise, with the national existing home median home price at $396,900, which is an increase of $18,000 or 4.8% from a year prior. Increasing costs of insurance and property taxes also contribute to affordability challenges. Locally in the Massachusetts market a similar trend is seen. Despite declining from the prior month, January 2025 single family home sales are 8% higher than January of a year ago. As seen in the chart to the left 2025’s January is better than each of the prior two years. Median home prices continue to rise on an annual basis as well, with single family prices up 7%. At $610,000 the median sale price is 13% below last year’s peak of $699,900 in June. Condo sales show a similar trend as well with a decline from the prior month, but a strong 21% increase in transactions compared to January of the prior year. Condo median prices continue to rise also, at $561,250 in January, up 8% from a year ago, but 3% lower than the $580,000 peak of last June.

Earlier this week markets got further details on the thoughts of the Federal Reserve board members from its January meeting, where the Fed decided for the first time in four meetings to hold rates unchanged. Fed leaders agreed that they would need to see more progress on inflation towards their 2% target before reducing rates further. The Fed noted that the labor market remains solid, with near maximum employment. Regarding inflation, Fed members noted increased upside risks. Consumer expectations are trending towards higher sustained inflation and additional changes in trade and immigration policies may lead to additional inflation pressures as additional tariffs and a reduction in available workers pressure price levels higher. Additionally, there are potential positives to economic growth from proposed changes to policies around reducing government regulation and taxes. The Fed is in a good position following 100 basis points of rate cuts to be in a wait-and-see stance – economic output and growth remains solid and current interest rates are significantly less restrictive than before the Fed started cutting rates.

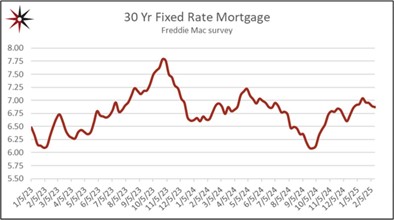

Mortgage rates remain elevated from levels that would stimulate the housing market. Economic data continues to point to little that will substantially move rates barring data surprises. 30-year fixed mortgage rates have been trending in the upper 6% range for the past quarter as uncertainty persists in the economy. The treasury curve remains priced for term premium with the 10-year some 20 basis points higher than 2-year following a prolonged period of inversion. Uncertainty looms large over the economy with potential changes at nearly every turn. Markets will look to next week’s PCE inflation for the direction on potential future Fed rate changes.

The content of this publication is provided for informational purposes only and is not intended to recommend any financial decision or course of action. Any financial and investment decision should be made in consultation with your financial advisors and representatives and should be evaluated at your own risk.

2/14//25

This week’s economic news was headlined by Federal Reserve Chair Jay Powell speaking before lawmakers on Capital Hill for his semiannual regular testimony. As expected, Powell stuck to the script of what the Fed has been telling markets recently. The labor market remains solid, and inflation has eased but remains above target. The Fed remains committed to its 2% long term inflation goal and is in no rush to resume rate cuts until further progress is made on inflation.

Turning to inflation, we got two readings this week, the Consumer Price Index (CPI) and the Producer Price Index (PPI). Coming first this week January’s CPI inflation surprised a bit to the upside with headline CPI showing a 0.5% increase from the prior month, higher than 0.3% expected, and a 3.0% price increase pace over the prior 12 months, also higher than expected. Stripping out more volatile food and energy prices Core CPI was also higher than anticipated at 0.4% from the prior month and 3.3% over the prior 12 months. The price for eggs has been making headlines as a bird flu outbreak has significantly reduced the number of egg laying chickens sending the price index for eggs up 15.2% from the prior month and a whopping 53% from the prior year. Many retailers are rationing how many eggs each consumer can purchase. The shelter index, which is the CPI’s measurement for housing prices, rose by 0.4% from the prior month and 4.4% over the prior 12 months. This annual pace is down slightly from 4.6% in the prior month. Markets reacted strongly to the higher CPI reading, adjusting again to a closer alignment with the Federal Reserve which continues to signal fewer rate cuts than markets have been calling for. Treasury yields jumped some 10 basis points immediately following the news, only to decline back slightly below original levels by the end of the next days trading session, dragging mortgage rates along for the ride as well. As seen in the chart, since the start of the year 30-year fixed mortgage rates have been slightly under 7% and appear to be range bound for the near term barring some unseen major economic announcement from the Trump administration or dramatic shift in inflation data.

Yesterday’s PPI inflation increased 0.4% from the prior month also slightly higher than expectations for 0.3%. The PPI inflation can be seen as a bit of a leading inflation indicator but typically has much less market impact than the more popular CPI. Market expectations for Fed rate changes are now largely expecting just one rate cut this year, with many even forecasting none. Rate expectations continue to adjust with incoming economic data, direction from the Federal Reserve and the current political environment. The Trump administration has been quick to work on delivering on campaign promises with big moves in many areas including uncertainty regarding many government agencies employment and ability to enact and enforce policies along with the possibility of additional tariffs on global trading partners.

The content of this publication is provided for informational purposes only and is not intended to recommend any financial decision or course of action. Any financial and investment decision should be made in consultation with your financial advisors and representatives and should be evaluated at your own risk.

Webinar - How Leader Bank helps your clients move with the market

Hear from Head of Residential Lending at Leader Bank, Sean Valiton, to discuss the new Move and Improve Line, recent NAR settlement news, and what Leader is doing to ensure you and your clients have financing options for buyer agent commissions.

The Building Interest Podcast - Presented by Leader Bank

A Reminder to Stay Nimble with Sean Valiton

On this week's episode of the Building Interest Podcast, Leader Bank's Senior Vice President & Head of Residential Lending, Sean Valiton, discusses Entrepreneurship 101. In this episode, we cover the importance of evolving and changing, surrounding yourself with like-minded people, and how your personal life can teach you to be a better leader.