LLPA Changes: A Simple Explanation For Homebuyers LLPA Changes: A Simple Explanation For Homebuyers

Loan Level Pricing Adjustments, or LLPAs, are fees set by a government agency called the Federal Housing Finance Agency (FHFA). LLPAs are charged to borrowers to compensate for the risk factors of their mortgage. Typically, these fees are part of the interest rate paid on your loan.

LLPAs have been around for many years but have recently undergone some changes which are designed to allow the FHFA to support borrowers limited by wealth or income while also ensuring a level playing field for lenders of all sizes. The interest rate you pay on your mortgage is determined by several factors such as your credit score, loan-to-value ratio, debt-to-income ratio, and whether you’re living in the property or owning it as an investment or vacation home.

Let's dig into some of these factors a little more:

- Credit Score: You’re probably already familiar with credit scores. It is a number between 300 and 850 that reflects how you use credit including how timely you’ve made payments in the past and how much of your available debt you are using. You can learn all about them here. Prospective homebuyers with higher credit scores are generally viewed as less risky to lenders.

- Loan-to-value (LTV): This is a ratio of how much of the value of the home you are borrowing. Imagine you are buying a home for $500,000. You put down $100,000 (20%) and borrow the remaining $400,000 (80%). The loan-to-value for this purchase would be 80%. Lower LTVs are generally viewed as less risky by lenders.

- Occupancy: Loans on homes where the owner and mortgagor are not living in the property are generally viewed as riskier. Should something happen to the mortgagor’s source of income and ability to make timely mortgage payments lenders generally assume that a borrower’s primary residence mortgage payment would be prioritized over other properties the borrower is not living in.

What is changing with LLPAs in 2023?

So what exactly is changing with LLPAs and what does it mean for homebuyers? There are two notable changes:

- A new fee structure that went into effect on May 1, 2023

- The introduction of an LLPA fee waiver for first-time home buyers who meet area median income requirements.

Fee Structure Changes

First, let’s take a look at how the FHFA changed LLPA fees charged to borrowers as of May 1, 2023. These changes will help people in some scenarios but will make other scenarios more expensive.

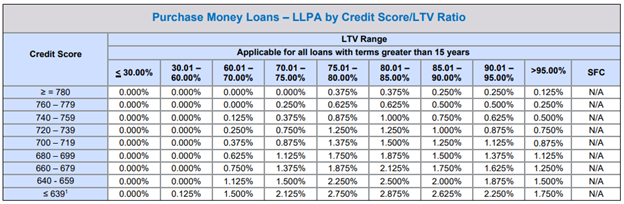

Let’s first look at the new fee structure for mortgages for a purchase transaction. The fees noted below are shown as a percentage of the loan amount, not the interest rate you pay on your mortgage. What’s not changing is that borrowers with higher credit scores and lower LTV ratios are charged lower fees.

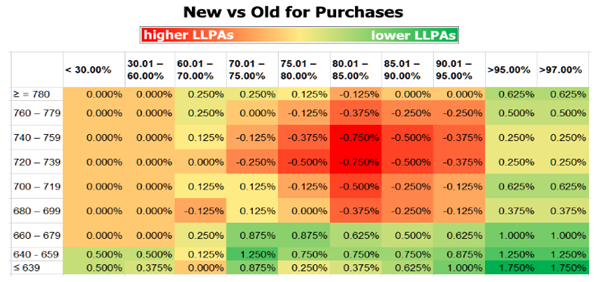

Now, let’s take a look at how these are different from the prior fee structure:

From this chart, we can see that some scenarios have no change, some increased and some decreased.

AMI Based Waiver

In order to support homeownership for first-time homebuyers whose income is at or below the area median income (AMI) where the property is located the FHFA is waiving all LLPAs for qualifying borrowers. To find the area median income for an area, you can use this tool.

What does this mean for you?

So how do all of these changes impact you? Most significantly, these changes could increase your interest rate, which can be expensive over the life of your loan. Rather than paying a higher interest rate for the life of your loan, it may be more beneficial to pay the fees upfront. “Paying points” is when you pay a fee at closing for a lower interest rate.

The changes to the LLPA fee structure are a complicated topic and can be confusing for homebuyers. It’s important to have a partner that can help you navigate the complexities of the new LLPA fee structure. If you have any questions at all don’t hesitate to reach out to one of our experienced loan officers with any questions you may have about how these changes impact you.