Time & Money: The Youth Advantage Time & Money: The Youth Advantage

The news has been full of stories about the coronavirus, reopening the American economy, the 2020 presidential race and more. For many consumers, rent, mortgage and monthly bill payments are just as big – and more tangible – issues than world and national news. In addition to figuring out how to manage in unprecedented circumstances, times like this generally lead people to think about how they got to their current position and what they would do differently if they could. Two common things that many people wish they would have done sooner is learn about personal finance and develop savings habits at a young age.

Coming out of quarantine and figuring out how to move forward might be an opportunity for you to use this experience to help a young person get a solid start on preparing for unexpected situations and a better financial future.

The Rule of 72

Not everyone has an affinity for math, but it’s safe to say most of us like money. The Rule of 72 is a fun and thought-provoking conversation starter about saving for one’s future. Simply put, the Rule of 72 is a simple way to determine how long an investment will take to double given a fixed annual rate of interest. Without resorting to scientific calculators or getting into logarithmic functions, here’s an easy way to show the Rule of 72 in action:

- Initial Investment: $1,000

- Rate of Return: 8%

- Determine time to double investment: 72 / 8(rate of return) = 9 (years)

- Year 1: $1,000

- Year 8: $2,000

- Year 18: $4,000

- Year 27: $8,000

The idea of waiting 27 years seems like an eternity to young people; but once the premise is understood, shift the conversation beyond a single, one-time investment to regular investment and the numbers become bigger and more exciting.

Systematic Savings

To a young person getting an allowance or wages from a summer job, the idea of “saving” can feel like “depriving.” Try reframing the concept in a positive way: Rather than removing money from dollars available to spend on fun things, try describing saving as “paying yourself and investing in the future.” The idea of “paying yourself first” and “investing in yourself” is a great follow-up to the Rule of 72. After discussing the concept of how money can grow as in the Rule of 72, systematic savings are the action step toward long-term gains.

Time Really is Money

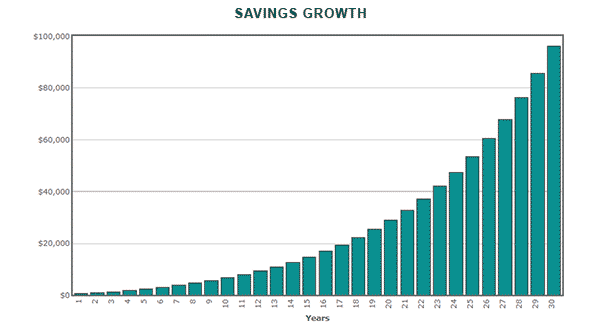

While a lot of kids are looking ahead to things like turning 10 and “reaching double digits” and their 16th birthday so they can drive, discussing the idea of time and money can really illustrate the awesome advantage time can give youngsters. Financial planning professionals have many real-life examples of people who made average incomes and retired as multi-millionaires. The key is getting started with saving and sticking with it. Here’s a visual showing how investing $25.00 per month and increasing that by 10% each year grows over a 30-year period at an 8% return:

The economic effects of the pandemic are still unfolding, and it’s likely they will last for years to come. Children and young people are watching their families experience the widespread effects of the coronavirus response, so it’s a good time for a conversation in plain terms about how to get started on a solid financial future. Helping a young person understand the value of money and develop the motivation and discipline to save is a priceless gift that lasts a lifetime.